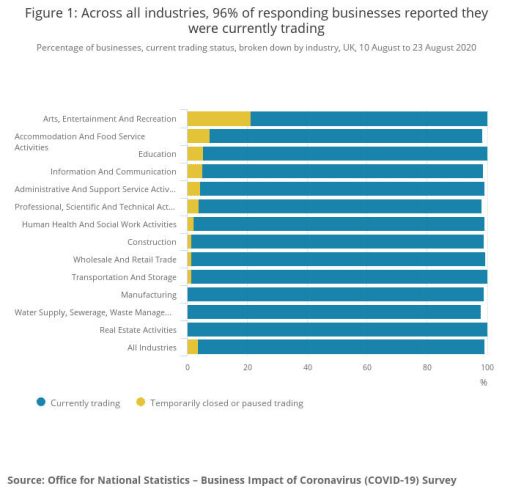

September's first survey by the Office for National Statistics on Business Impact of coronavirus has once again shown arts and entertainment as the industry worst affected by the pandemic.

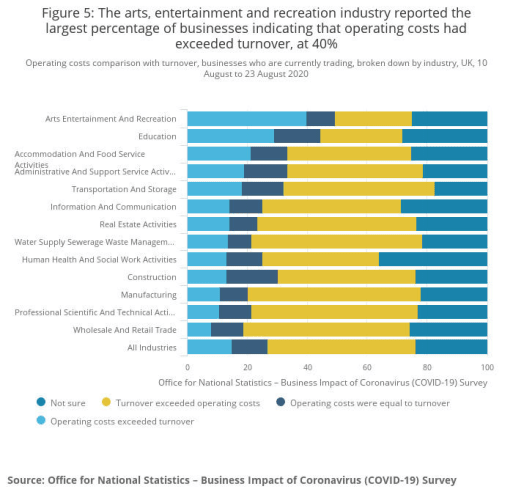

The report makes sorry reading, revealing the sector has the highest percentage (40%) of businesses where operating costs have exceeded turnover. Earlier editions show the sector as having the highest proportion furloughed workforce, the highest self-rated risk of insolvency and most decreased footfall.

The latest survey results were published the day after the Opposition Day Debate in the House of Commons calling for targeted income support for the hardest hit, and a few days after the announcement of the proposed 1 November reopening for live entertainment venues.

The Incorporated Society of Musicians was amongst those to respond to the proposed un-distanced reopening from 1 November, damning it with faint praise—"a welcome step"—whilst pointing out, as the ISM and others have already done, that for many Christmas productions it is already too late.

Equity said that "non-socially distanced re-opening is only a reality if the government provides a financial safety net to the variety and theatre workforce and producers in the event of further stoppages due to reasonable public health precautions.

"Equity is particularly concerned at the suggestion that the government will make demands for 'dynamic pricing' of theatre tickets without any additional funding available for theatres."

The cancellation and downsizing of so many Christmas shows is a further blow to the sector's self-employed workers since not being able to work at the most profitable time of year after some six months of no employment (and for many no income or support either) exacerbates financial difficulties that are already at critical levels.

The ISM reports that many members are in "desperate financial difficulty" and it is among 120 organisations calling for a targeted financial support scheme for freelancers and an extension of the Self-Employment Income Support Scheme until such time as live performance venues can operate at full capacity.

North of the border, the Scottish Government has committed to giving £5 million of their Culture Recovery Fund as grant funding for creative freelancers in financial hardship, whilst also delaying the reopening of live performance venues until 5 October, conditional on distancing and other restrictions.

The government's would-be panacea for the sector, the 'moonshot' strategy of mass testing audiences at venues, failed to receive a rapturous response. This is for a number of reasons, not least that, even if it can be delivered and operates successfully, it will arrive too late for many of the sector's self-employed, only some of whom have been able to access financial support.

In this week's Opposition Day Debate, MP for Brighton Pavilion Caroline Lucas talked of the "huge injustice being done to the self-employed, many of whom have gone for six months without any support whatsoever". These are the more than 3,000,000 people in the UK, for example newly self-employed, freelancers, and workers on short-term PAYE contracts, who are ineligible for help from government schemes.

ISM chief executive Deborah Annetts has emphasised the urgency of the situation.